Wells Fargo

The Branch of the Future

Unified Customer Profile: Transforming the ecosystem and experience

Microsoft collaborated with Wells Fargo in the commercial and treasury sectors. Now, there's a chance to penetrate the consumer aspect. Making use of Cloud for Finance's potential, Microsoft endeavors to infiltrate Wells Fargo and propose a comprehensive substitute for Salesforce’s Customer 360. Their aim is to have this implemented into the Wells Fargo infrastructure during the subsequent phase in early January.

The branch of the future is more than just the physical location or a digital platform. In this consumer-driven world, it’s all about experience.

Vision

Oftentimes, banking can feel siloed and disconnected—like a one-sided conversation. Microsoft is looking to create a connected and seamless experience for everyone in the Wells Fargo ecosystem. We do that through technology built to support experiences in an intelligent way. Simplifying tasks so people have more time to connect.

Workshops

How might we build deeper customer relationships and unlock growth by seamlessly orchestrating, enabling, and measuring engagement across the consumer bank?

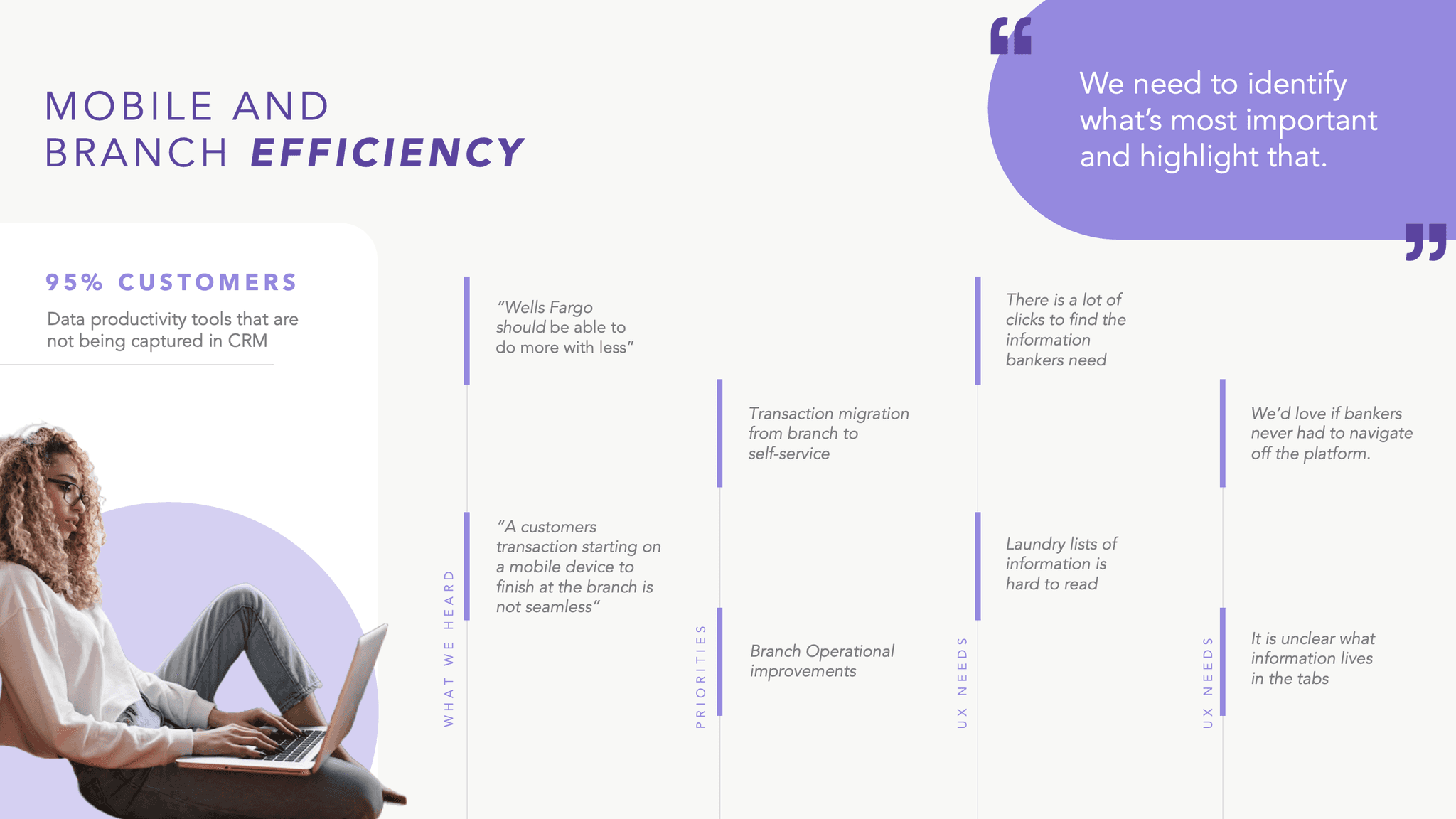

95%

Customers

Data productivity tools not being captured in CRM

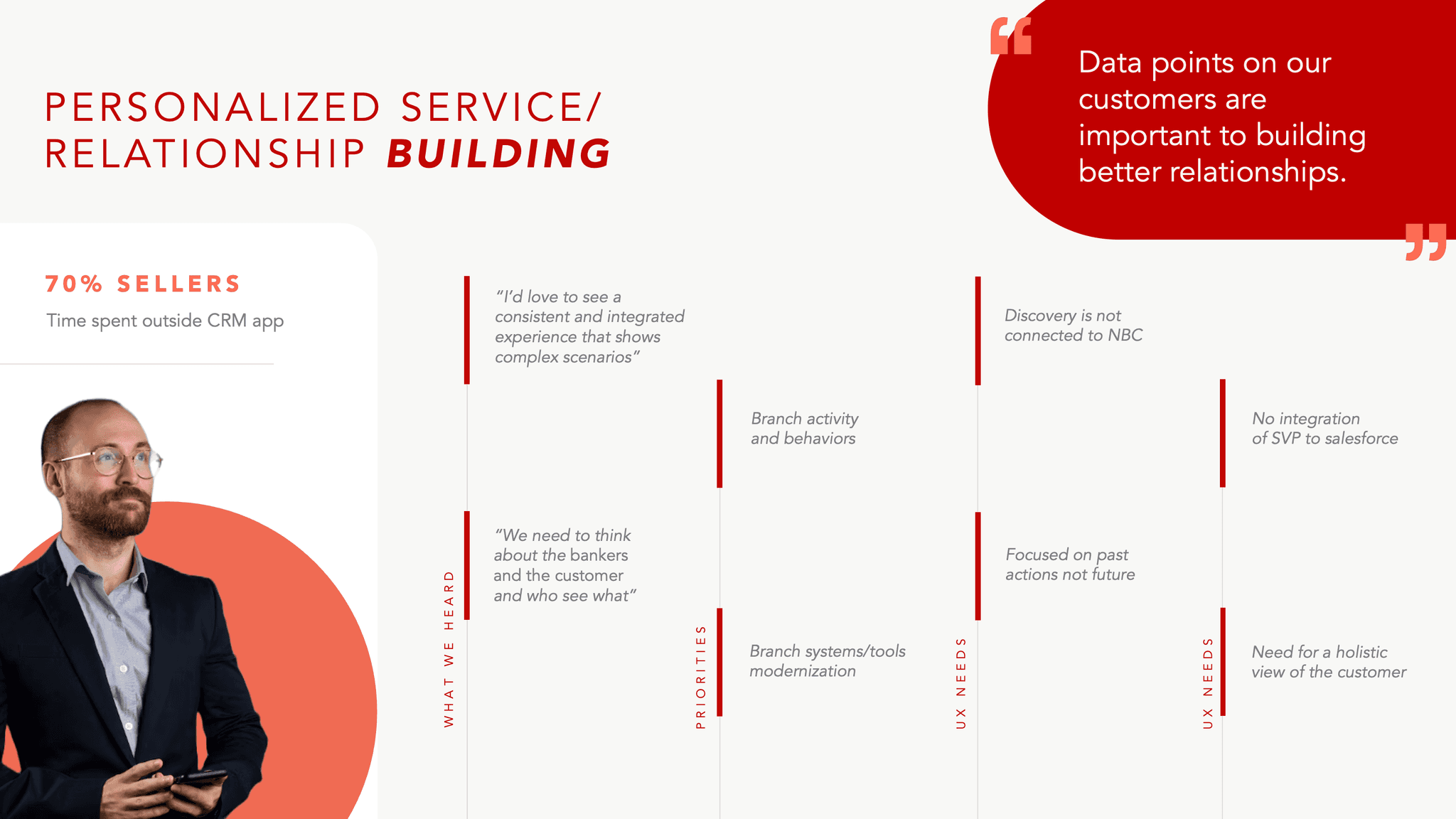

70%

Sellers

Time Spent outside of the CRM

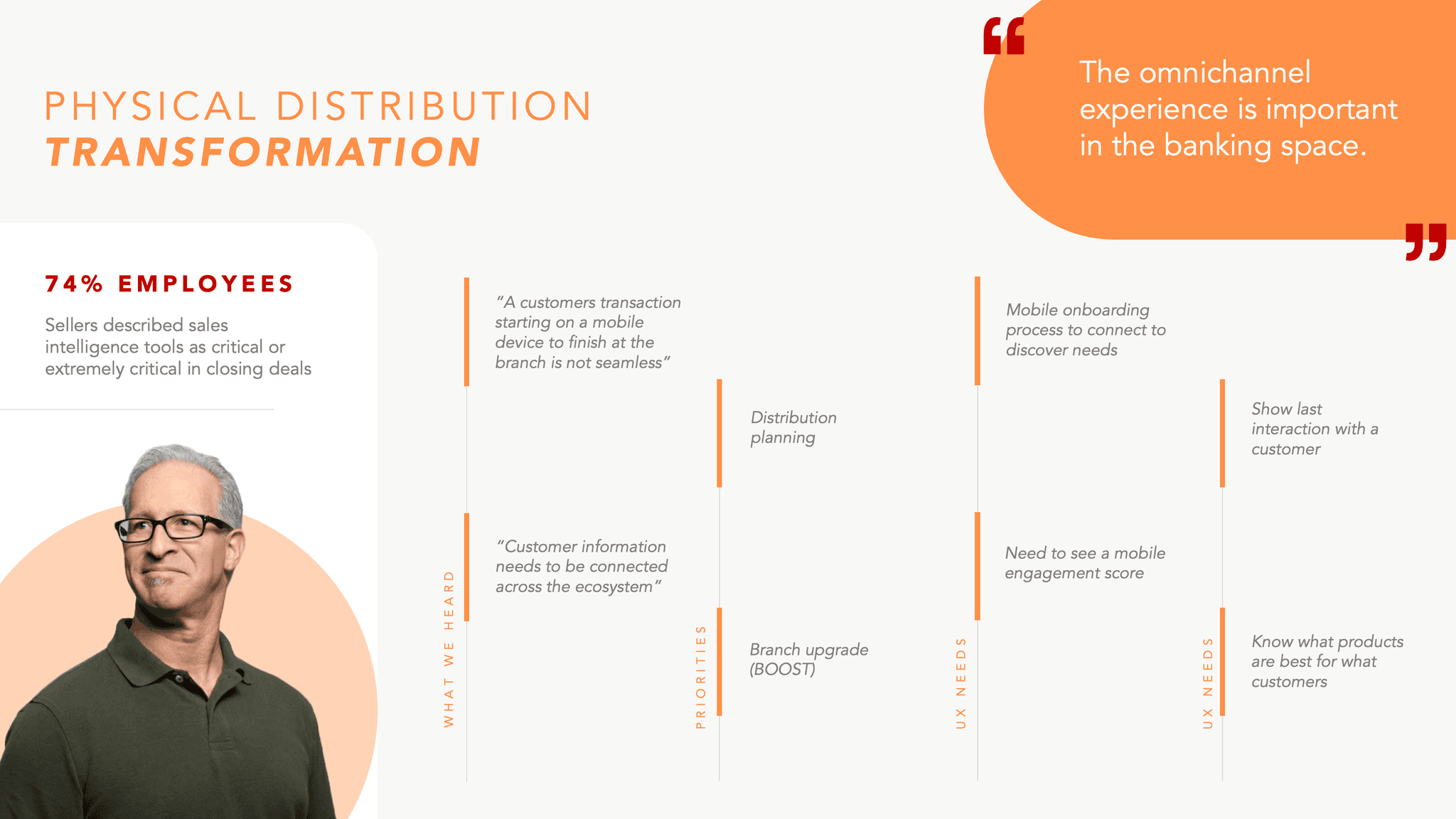

74%

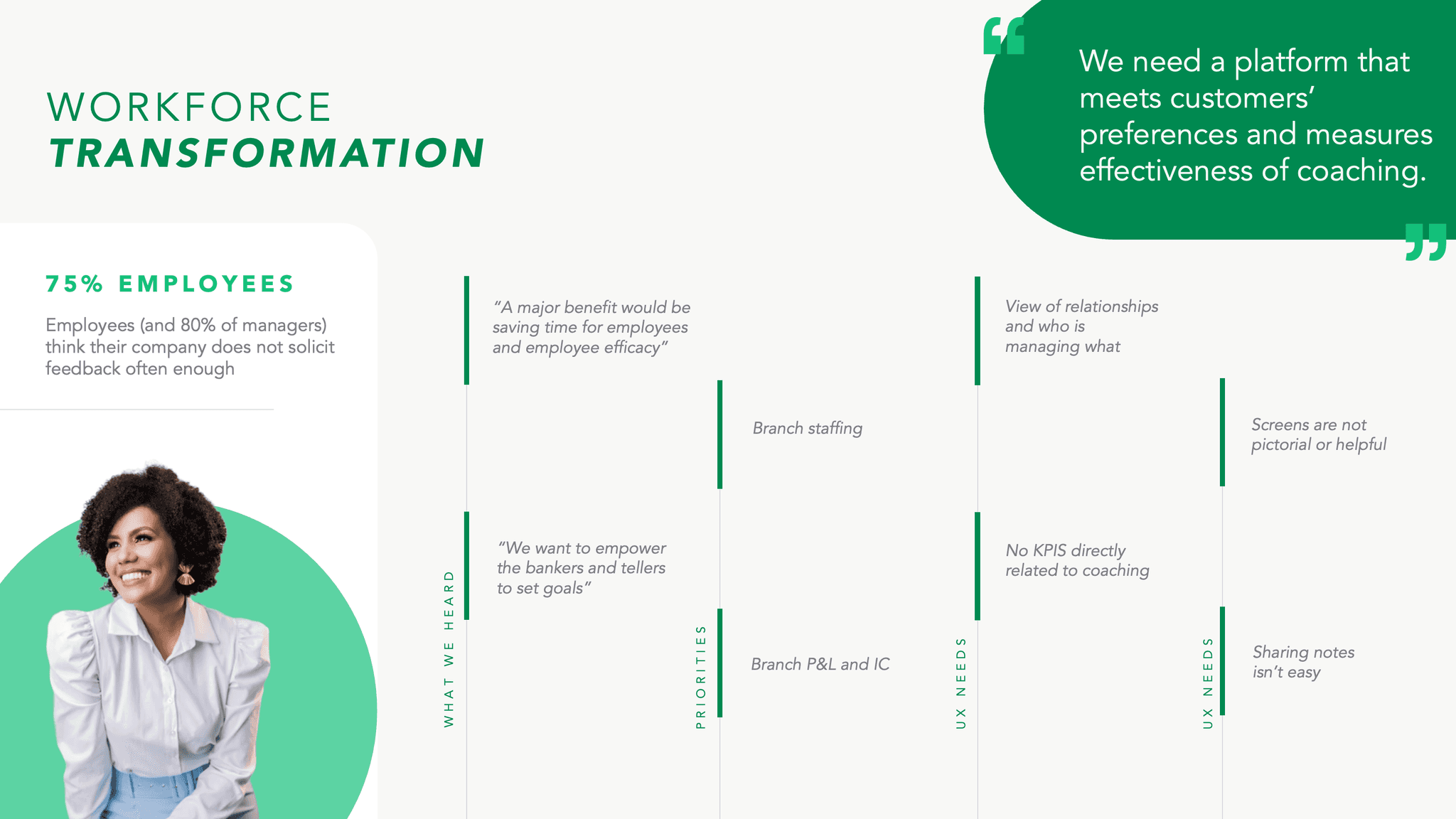

Employees

Sales intelligence tools are critical in closing deals

80%

Managers

Think company does not solicit feedback enough.

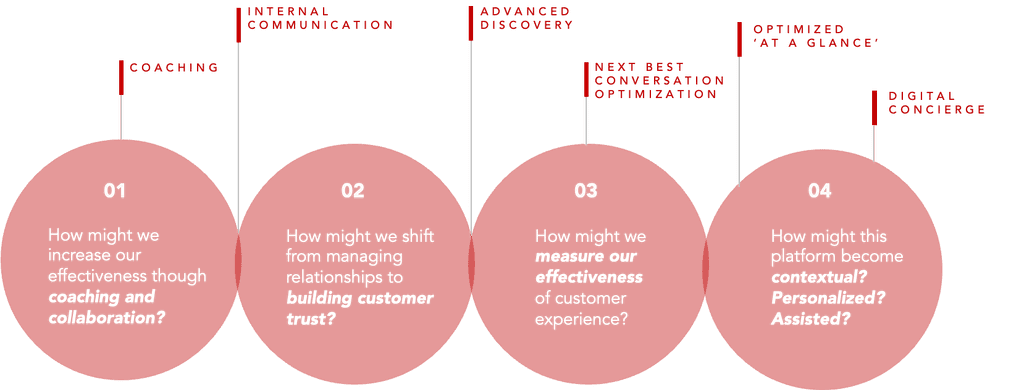

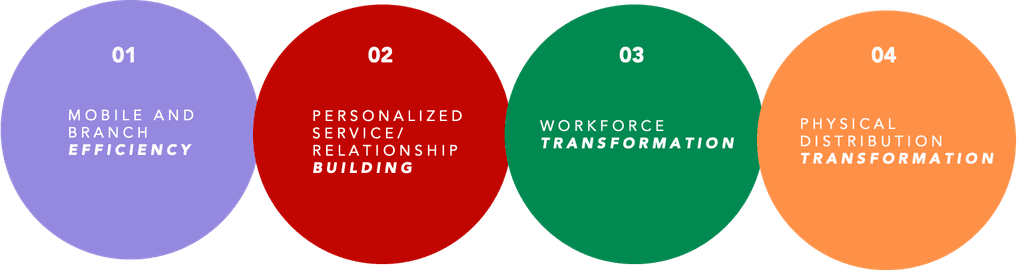

Crafting Strategic Pillars

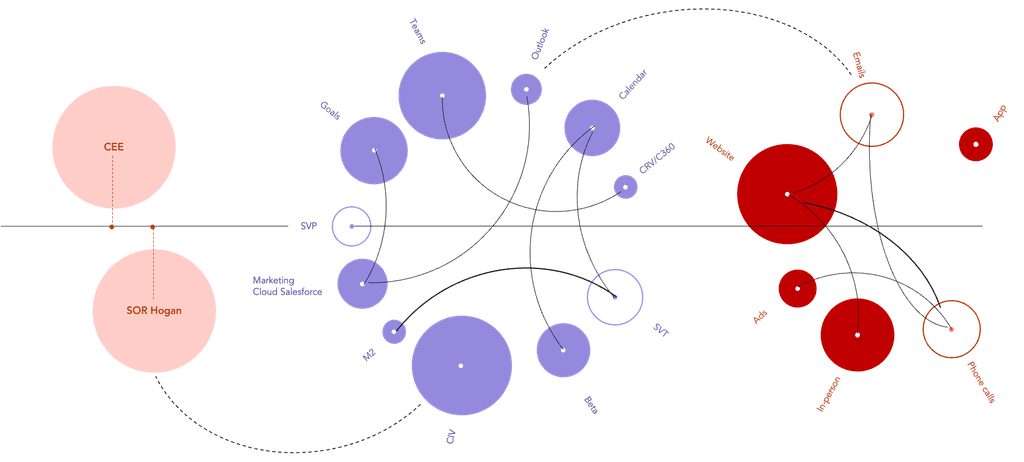

DISCOVERY

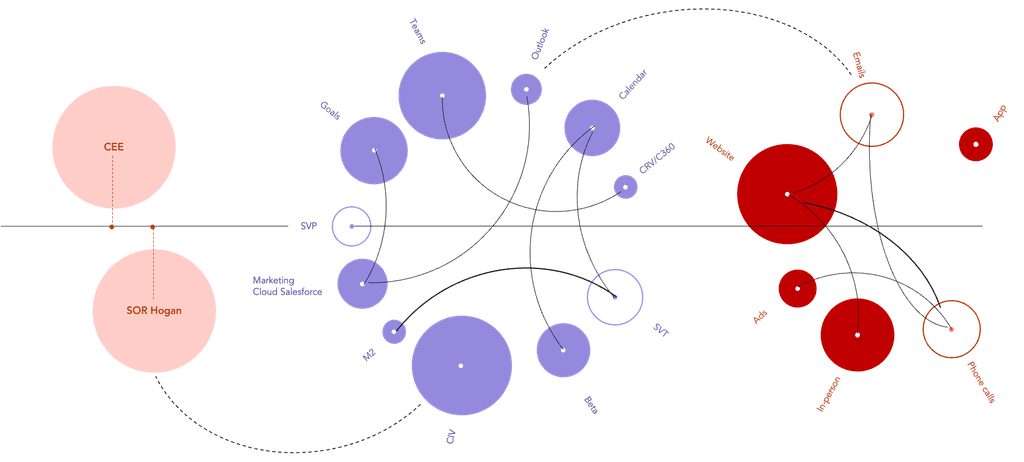

A Fragmented Ecosystem

I love the discovery and design processes. Design is a response to discoveries. In looking at all the ecosystem of Wells Fargo utilizing Microsoft's technologies mixing with their workflows, we noticed a large ecosytem of connecting many pieces, yet fragmented. This led us to conceptualize our hypothesis of "Orchestration" as a key strategy towards a successful and Unified Customer Experience

HYPOTHESIS

Orchestrating an integrated customer and employee experience at Wells Fargo

STRATEGY + TECHNOLOGY

Ecosystem Orchestration

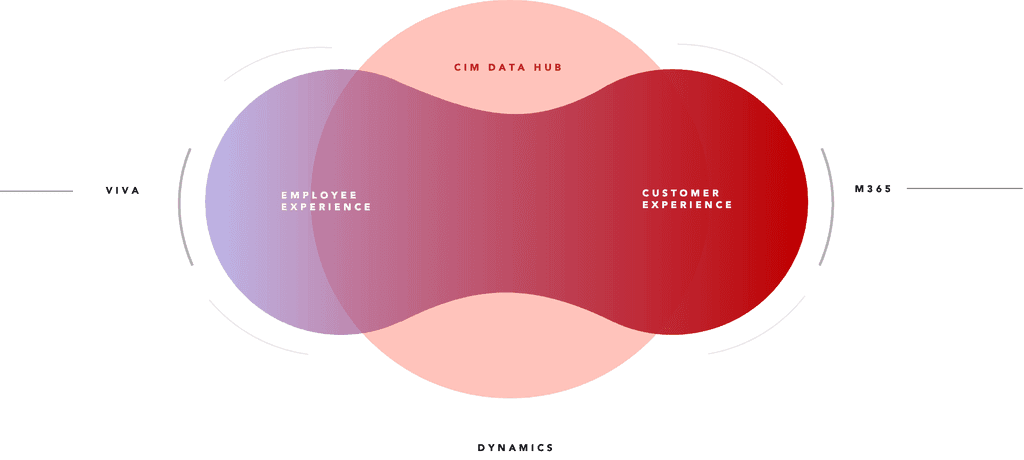

The entire solution was intended to be built on Microsoft platform and capabilities. In our orchestration strategy we needed to connect and unify employee expereince and customer experience as much as possible. The foundation technology stack making it possible was built on Microsoft Dynamics and CIM Data Hub, while on the side of employess VIVA and for customers M365 would be the enabling technology.

We regularly worked with Microsoft designers and engineers to ensure the feasiblity of the solution.

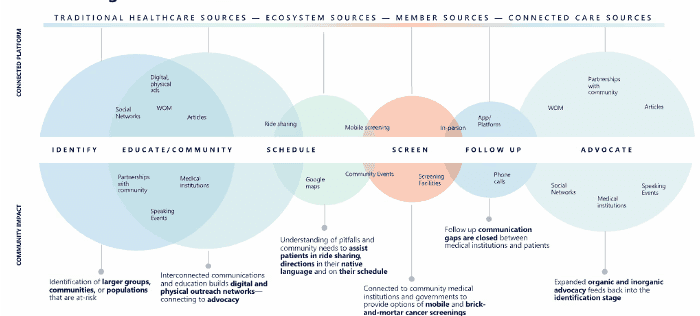

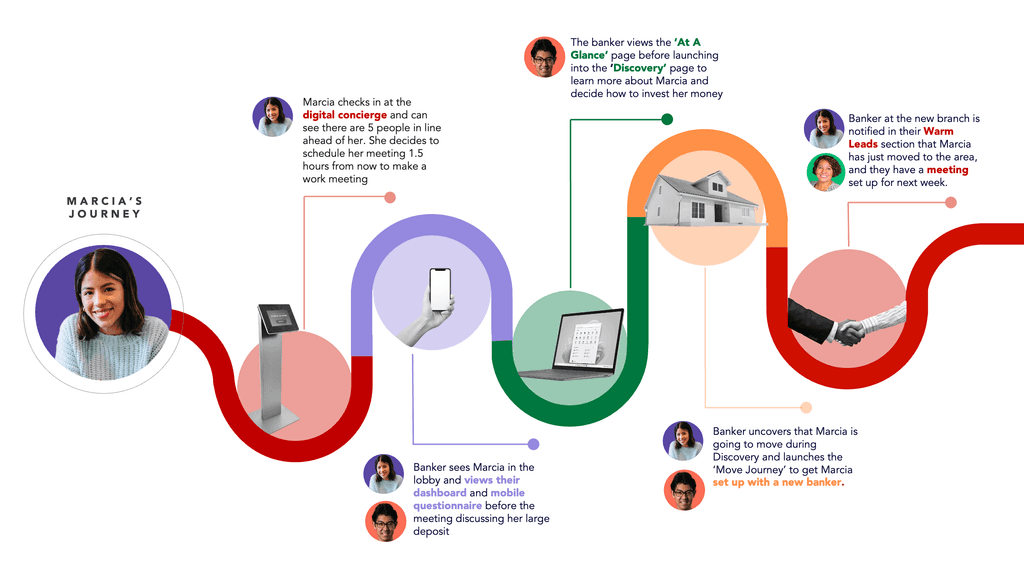

Persona Research & Journey Map

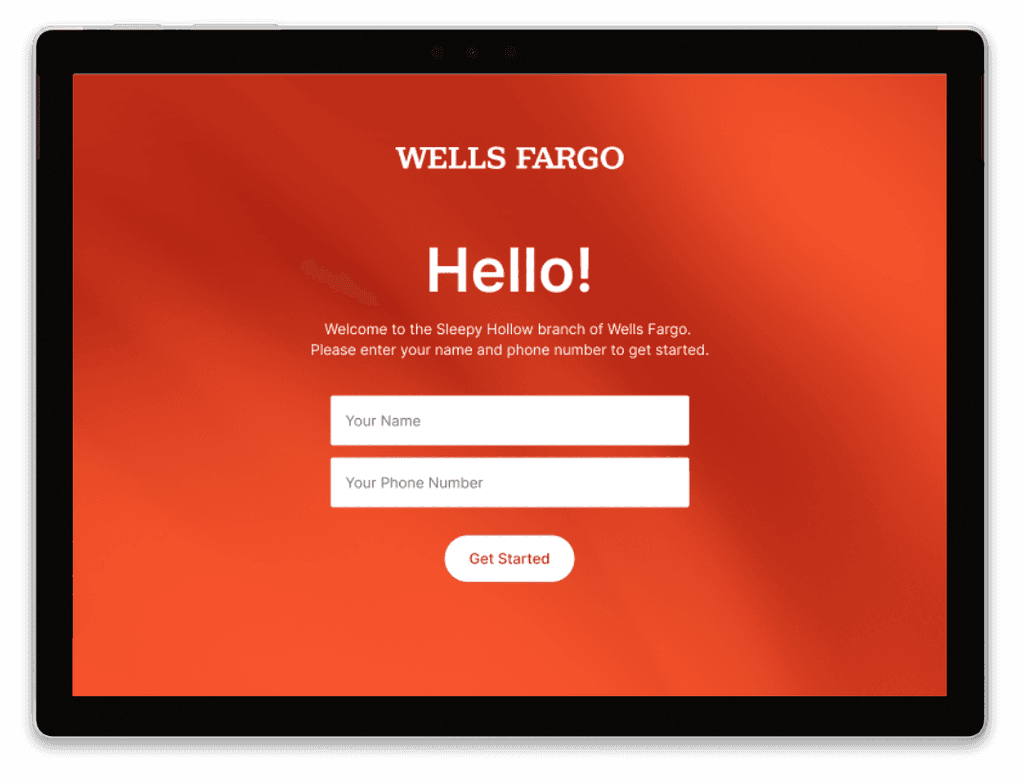

The Digital Concierge

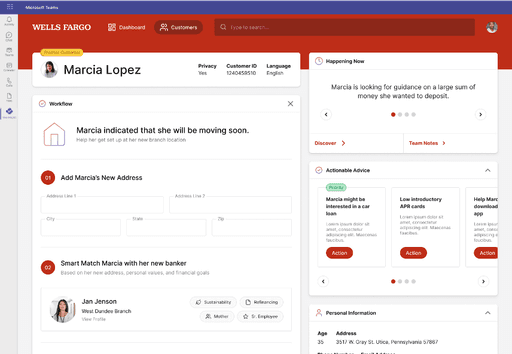

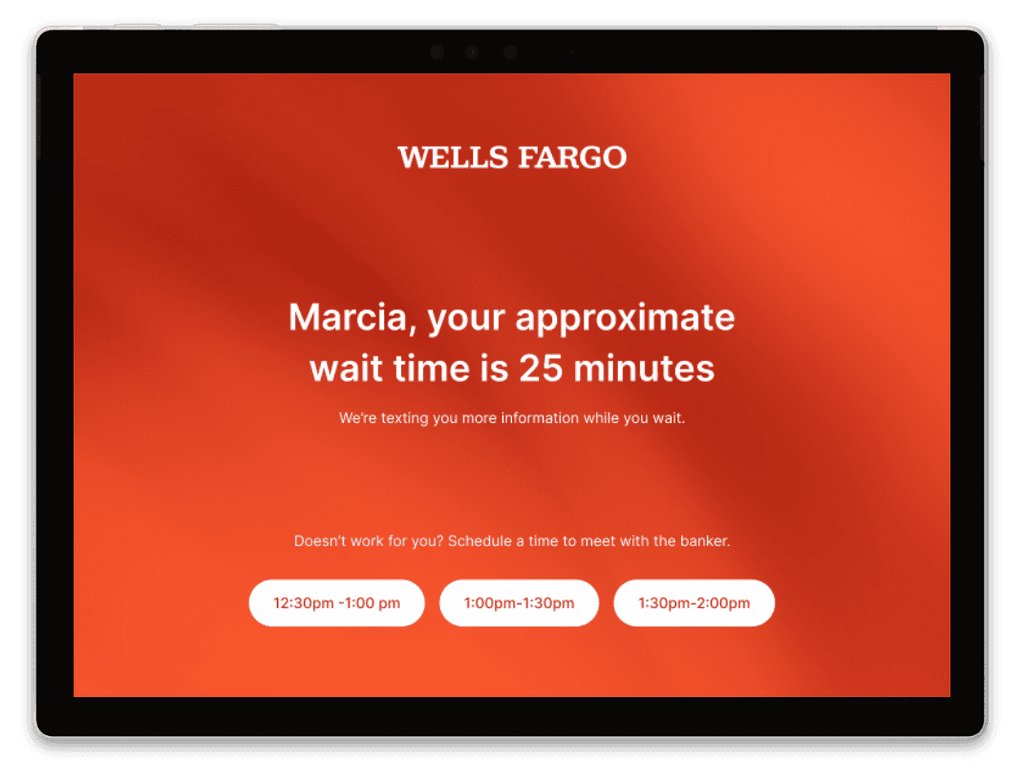

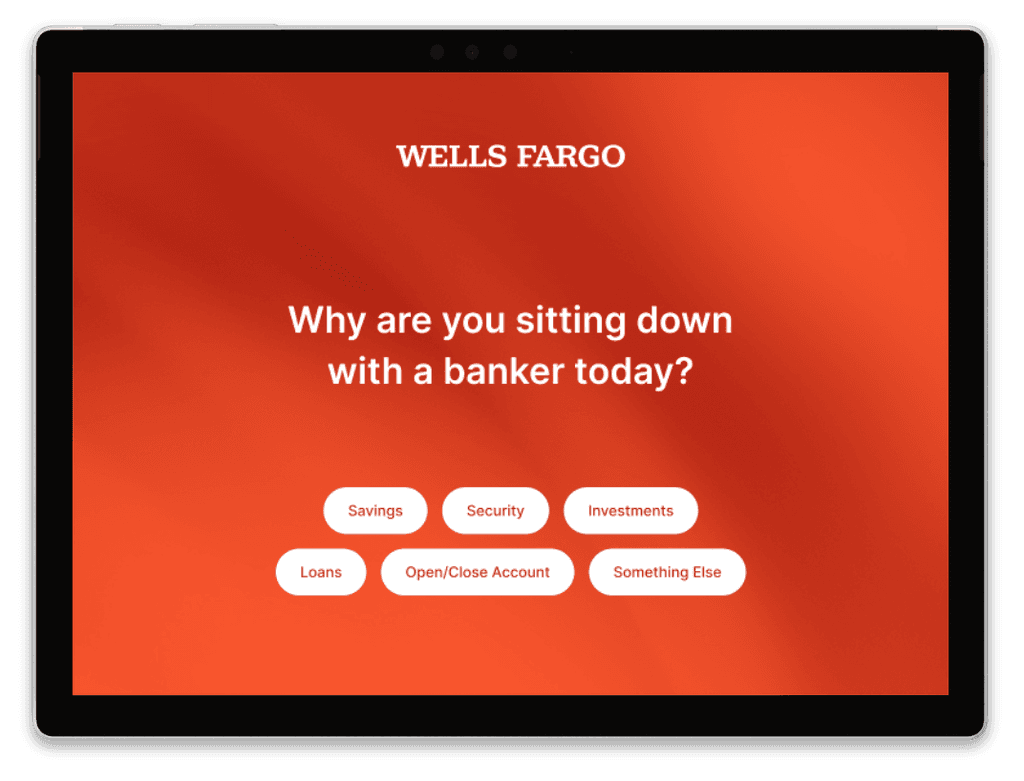

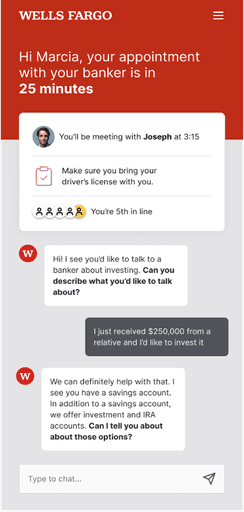

From the strategy, we identified an integrated digital and in-person experience and looked into the current journey map of Wells Fargo customers. We noticed that there was a disconnect when the customer (Marcia) would show up at the bank despite a prior online appointment. Also, the Banker had little insight into the exact needs of the customer. The digital concierge became a key on-site solution for customers, especially for less-digitally savvy customers. It was an easy solution that allowed for both check-ins and letting the banker know about the nature of the customer's needs.

Customers could skip the Digital Concierge, make all the appointments, and track them through their Wells Fargo app. The intention here was to remove any friction touchpoints that would cause a disconnect between the banker and customers.

THE PRODUCT

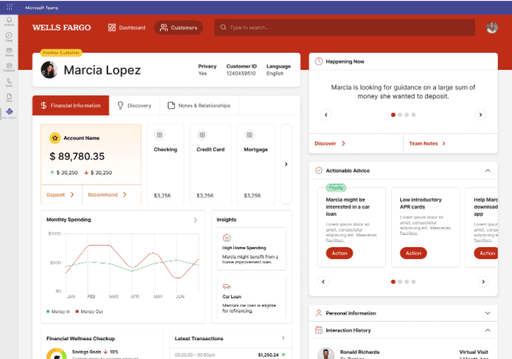

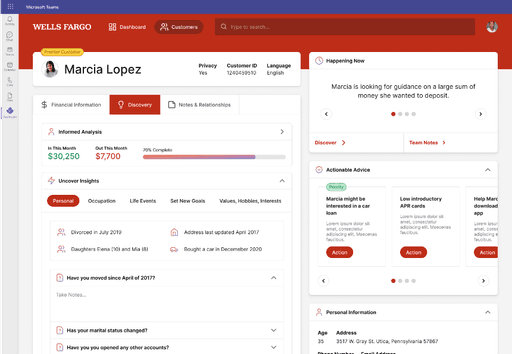

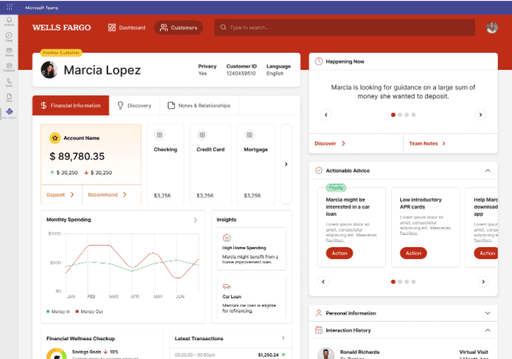

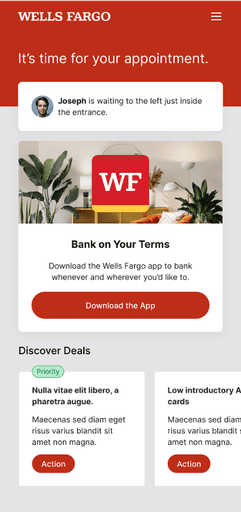

The Banker's Intelligent Dashboard

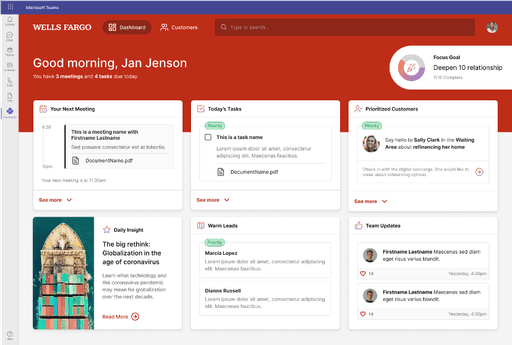

Reimagining the Banker's dashboard was the key solution in this integrated ecosystem. Once Marcia is ready for their appointment, because of the orchestrated ecosystem, the banker already has all the information and insights into Marica'a's accounts, needs, and possible products that might fit Marica's needs. The intelligent dashboard can provide insights into Marica's spending patterns and recommend solutions. In the end, the banker gets feedback and badges for the performance and also receives daily insights.